|

| |

|

|

| |

全球豪宅市場中的融資新局

當 2009 ~ 2021 年初美國房貸利率處於歷史低點時,精明的高淨值人士 ( HNWIs ) 把握機會,透過「超額房貸 jumbo loans 」進行房地產投資。這個名詞指的是超過政府支持的資金機構『房利美 Fannie Mae 』 與『房地美 Freddie Mac 』 所規定上限的貸款。到了 2025 年,在大多數市場中,這樣的貸款金額指的是 806,500 美元以上,而在高成本地區,則是 1,209,750 美元以上。

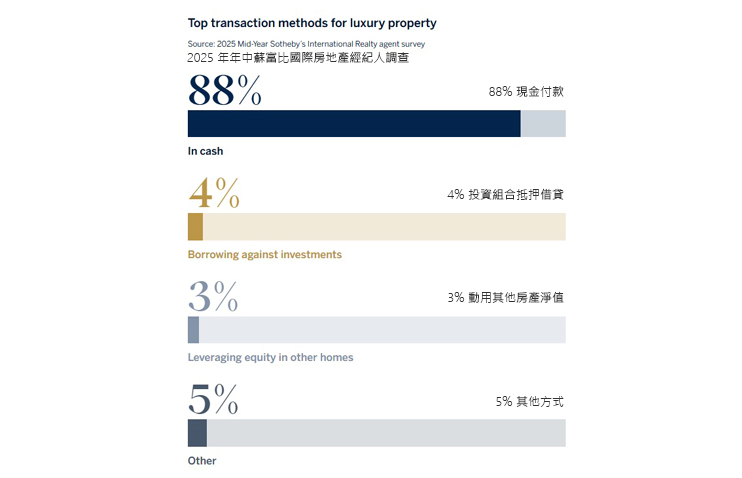

然而在當前高利率環境下,富裕買家傾向於直接付現購置房產。根據 2025 年中的蘇富比國際房地產經紀人調查,全球 88% 的高資產淨值人士 ( HNWI ) 客戶選擇以現金支付。

LIV 蘇富比國際房地產全球房地產顧問 Dan Dockray 指出「我們市場裡約 80% 的交易是現金支付」。至於少數需要融資的客戶,通常能拿到比市場利率低至少 1 個百分點的優惠,因為他們與銀行的合作關係緊密。 2025 年初,這些借款人的超額房貸利率大多落在 5% 以下,而一般借款人接近 7%。有些買家甚至直接以資產槓桿套現,金額高達 200 萬美元以上。

與傳統超額房貸相比,超額房貸因審查繁瑣且費用高昂,核准往往需要數週;而以投資組合抵押的貸款,卻可能在一天內就能獲批。紐約資產管理顧問公司 FFT Wealth Management 創辦人暨執行長 Keith M. Bloomfield 表示:「我們的保證金貸款利率比一般超額房貸更低,借款人最高可動用投資組合市值的 50%。這完全取決於利率、投報率,以及客戶是否需要資金投入事業或其他用途。」

瑞銀集團 UBS、摩根士丹利 Morgan Stanley、雷蒙詹姆斯金融公司 Raymond James 等金融機構也針對將投資組合託管於該行的客戶,提供精緻的房地產融資方案。家族辦公室資源顧問集團 Family Office Resource Group 創辦人 Brian Weiner 也提醒:「投資組合淨值會隨市場波動,若遇到重大修正,借款人可能需要額外補足差額。此外,與金融機構綁定後,想更換合作對象並不容易。」

另一個常見選擇是家族內部貸款,通常透過信託或有限責任公司進行,讓超高資產淨值人士 ( UHNWIs ) 能為家族成員購屋融資。這類貸款利率通常遠低於傳統房貸,可達到顯著的成本節約。例如 2025 年 3 月,美國國稅局對超過 9 年期的家族貸款利率為 4.81%,明顯低於傳統房貸的 6.31%。

豪宅市場主流支付方式

豪宅市場的續航力

Dockray 強調,不同價位的買家對經濟因素的敏感度差異很大:「對 UHNWIs 而言,買賣房產完全是生活方式的選擇。但在 500 萬美元這個價位,我們往往會看到股市上漲時交易量明顯增加;低於這個價位的買家,則更容易受到利率影響。」

而在由創業家主導的交易中,通膨或其他與其事業相關的經濟因素,也可能左右他們的決策。仲介若能在初期就掌握客戶的銀行合作關係,將能避免跨境融資上的意外延誤。「最糟的情況,就是買家依賴外州私人銀行家,承諾能在當地市場操作,最後卻無法執行,導致交易破局。」Dockray 說。

文章節錄自 Sotheby’s International Realty 2025 奢華趨勢展望報告

|

|

| |

|

|

| |

FINANCING OPTIONS

When U.S. mortgage rates were historically low between 2009 and early 2021, savvy HNWIs jumped at the opportunity to invest in real estate with “ jumbo loans. ” This term refers to mortgages that exceed the limits set by the government-backed funding agencies Fannie Mae and Freddie Mac. In 2025, that means loans of US$806,500 or more in most markets, or US$1,209,750 in high-cost localities.

Today, wealthy homebuyers are still just as likely to invest in property around the globe, but they are more likely to pay cash now that borrowing costs are higher. According to the 2025 Mid-Year Sotheby’s International Realty agent survey, 88% of HNWI clients across the globe prefer to purchase real estate with cash.

“ Our market is 80% cash, but the few clients who borrow funds to buy a property usually pay interest rates well below the standard rate, ” says Dan Dockray, global real estate advisor, LIV Sotheby’s International Realty. “ These are buyers who have a strong relationship with their banks, which will typically shave at least a point off the market rate. ”

In early 2025, these borrowers typically paid 5% or less on a jumbo loan, compared to nearly 7% for other borrowers, he says. “ Some cash buyers are actually leveraging their investments and may be pulling US$2 million or more out in cash against their assets. ”

Unlike a jumbo loan, which can take weeks to access because of documentation requirements and can generate substantial borrower fees, loans against investments can often be approved in one day, says Keith M. Bloomfield, founder and CEO of FFT Wealth Management, a New York City–based firm that serves ultra-high-net-worth individuals ( UHNWIs ).

“ Our margin rates are lower than the prevailing jumbo mortgage rate, and borrowers can leverage up to 50% of their portfolio, ” Bloomfield says. “ It’s all a numbers game based on interest rates, their return on investments and whether someone needs capital for their business or another expense. ”

Financial institutions such as UBS, Morgan Stanley and Raymond James have excellent programs for financing property purchases for people who keep their investment portfolio with them, says Brian Weiner, founder and CEO of the Family Office Resource Group, a wealth management firm that also serves UHNWIs. “ The challenge with this approach is that securities portfolios tend to fluctuate, ” Weiner says. “ In the event of a serious market correction, the borrower may need to cover any shortfall. Another concern is that you’re committed to that financial institution, so making a change might not be so easy. ”

An alternative option is an intra-family loan, often made via a trust or a limited-liability company, which allows UHNWIs to finance purchases made by other family members. “ The rates for such loans are usually much lower than traditional mortgages, which can lead to amazing cost savings, ” Weiner says.

For example, as of March 2025, the interest rate established by the IRS for an intra-family loan of more than nine years was 4.81%, compared to 6.31% for a traditional mortgage.

Economic factors vary according to the level of wealth of the client. “For UHNWIs, property purchases and sales are purely a lifestyle choice,” Dockray says. “ At a lower price point, such as the US$5 million range, we tend to see more activity when the stock market rises. Buyers below that point are more likely to pay attention to interest rates. ”

However, many entrepreneurs drive real estate transactions, so inflation or other economic factors that impact their business could influence their real estate decisions. Successful transactions often hinge on clients sharing information about their banking relationships early in the process.

Understanding whether financial institutions can authorize and facilitate loans in specific markets—specifically in cross-border scenarios—can help prevent complications.

“ Agents need to know which lenders can work with wealthy buyers and what they can offer, which changes often, ” Dockray says. When a buyer needs to finance their purchase, it’s best to use local lenders whenever possible. The worst situation is when someone has an out-of-state personal banker, who says they can execute in our market but at the last minute they can’t. It can derail a deal to ask a seller to wait while your buyer scrambles to rearrange their financing.”

Source: Visit the Sotheby’s International Realty 2025 Luxury Outlook report for essential insights. |

|

| |

|

|

|

|

|

|