|

| |

|

|

| |

奢華復興|再現高端生活榮景

奢華商品和房地產的需求不一定同步,但都反映奢華市場的新動向。例如,2025 年 2 月,蘇富比拍賣在沙烏地阿拉伯的迪利耶 ( Diriyah ) 舉辦首場國際拍賣,拍賣品包括藝術品、手錶、珠寶、名牌包和運動收藏品。同一時間,舊金山市中心許多因疫情而空置的店面正被國際知名品牌重新進駐。印度越來越多的高淨值人士也開始購買名牌精品和豪宅,而波多黎各則成為富人購置度假屋或第二居所的熱門地點。

2024 年,全球個人精品市場經歷 15 年來首次小幅下滑,銷售額僅比前年少了約 1%,一些分析師認為這可能暗示高端市場整體成長放緩。麥肯錫顧問公司 ( Mckinsy & Company ) 在 2025 年 1 月的報告中指出:「 整個精品行業的成長動能暫時停滯。 」

奢華體驗推動消費

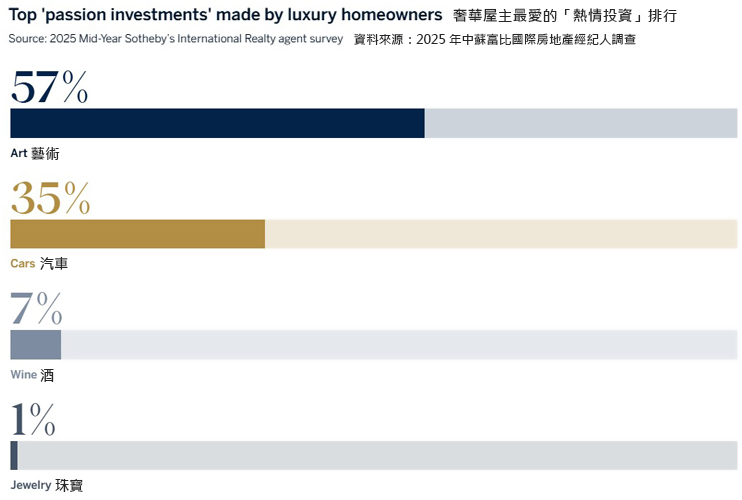

不過,國際知名的貝恩管理顧問公司 ( Bain & Company ) 的分析師則認為,名牌精品的長期消費趨勢仍然樂觀,只是消費者的偏好發生了變化。貝恩公司指出,今年奢侈品消費仍非常穩定,很大原因是消費者對「 奢華體驗 」的需求增加。追蹤數據顯示,奢華餐飲和美食消費上升 8%,私人遊艇和飛機增加 13%,郵輪市場則成長 30%。蘇富比國際房地產的調查也發現,豪宅買家最常投資的精品是藝術品和汽車。

豪宅市場的新價值

奢華消費的影響不只在商品和體驗,也改變了豪宅市場。蘇富比國際房地產高階主管 Tammy Fahmi 表示:「 豪宅市場現在不只看地段,住起來的感受也很重要。買家願意花大錢買那些能展現品味、提供特別體驗的卓越房產。 」

體驗型奢華持續成長

貝恩公司與義大利奢侈品協會的報告也顯示,雖然 2024 年名牌精品總消費略降 1% ~ 3%,但體驗型消費仍成長得比平均水平高,消費者持續把錢花在旅遊和社交活動上。未來幾年,市場預期會逐步好轉,到 2030 年,精品市場將迎來長期正向發展,可觸及的消費族群也會增加。

住宅和奢侈品市場互相影響

總的來說,不同地區的精品市場有不同節奏:有些地方奢華住宅先發展,帶動奢華零售;而其他地區則是成熟的奢華生活方式吸引富裕買家購房。住宅和精品市場互相影響,共同反映當地財富的創造和增長。

而儘管全球經濟存在不確定性,今年奢華消費仍展現出驚人的穩定性,主要原因是消費者對奢華體驗的強烈需求。

當奢華重返舊金山,再現高端生活的榮景

不久之前,加州舊金山的報導仍在描述零售商從市中心撤離的情況。如今,原本空置的店面正在被迎合超高資產族群的品牌進駐,將聯合廣場 ( Union Square ) 轉變為以預約購物及頂級歐洲零售商為主的高端購物目的地。根據房地產數據公司 CoStar 於 2025 年 2 月的報告,這個區域正展現出明顯的復甦跡象。

不僅是精品零售業者重返舊金山,根據 Bloomberg 於 2025 年 4 月的報導,包括金州勇士球星 Stephen Curry、Google 共同創辦人 Sergey Brin 以及多個資本雄厚的投資集團等知名人士,都開始積極購買舊金山的商用不動產。在住宅市場方面,代理人同樣觀察到超高端房產的需求正在上升。

「舊金山正重新展現信心與動能,特別是在市場的高端層級。」蘇富比國際房地產舊金山經紀公司 ( Sotheby’s International Realty - San Francisco Brokerage ) 的全球房地產顧問 Neill Bassi 表示。「 舊金山房市一直很有活力,人們相信明天會比今天更好。雖然曾經沉寂了一陣子,但現在買家都很有信心。 」

舊金山市區內的獨棟住宅市場,其中價格介於 700 萬至 800 萬美元之間的房產被視為豪宅,而超高端豪宅市場則從 2,000 萬美元起跳。「 2024 年,我們創下單一年內成交超過 2,000 萬美元豪宅數量的歷史新高。 」Neill Bassi 表示。由他主導的一筆成交案 – 位於舊金山海崖區 ( Sea Cliff ) 的 3,000 萬美元莊園 – 截至 2025 年 4 月已刷新紀錄。「 若你回顧去年 2,000 萬美元以上的成交案例,有些是坐落於雙地段、近十年內全面翻修、擁有壯麗景觀的房產;另一些則是位於難得一見的地段、進行多年整建的長期投資案。 」

如今的買家包括暫別舊金山四、五年後回歸的前居民,以及被科技產業吸引而新進的富裕人士。與過去那波多數選擇矽谷地區的買家不同,新一代買家更傾向於尋找如舊金山北部的普雷西迪歐高地 ( Presidio Heights ) 和太平洋高地 ( Pacific Heights ) 等高端社區。

舊金山不僅是創造財富的地方,更是一個能享受豐富生活的城市。優質的教育資源、鄰近頂尖大學、歌劇與芭蕾等文化設施、創新的科技生態圈以及高水準醫療體系,都是吸引高淨值族群的關鍵因素。「對超高淨值客戶而言,選擇在這裡安家立業,是極具價值的投資決定。」

「舊金山的高端房市正重新充滿信心與活力。」

—— Neill Bassi,蘇富比國際房地產舊金山經紀公司 全球房地產顧問

文章節錄自 Sotheby’s International Realty 2025 奢華趨勢展望報告

|

|

| |

|

|

| |

LUXURY RENAISSANCE

A look at the locations that are becoming or re-emerging as centers for high-end living

Demand for high-end goods and real estate might not run in tandem, but they are both good indicators of emerging or improving luxury markets. In February 2025, for example, Sotheby’s held its first international auction in Saudi Arabia. The sale in the historic town of Diriyah included fine art, watches, jewelry, handbags and sports memorabilia. In downtown San Francisco, California, meanwhile, esteemed international brands are moving into premises that had been vacated due to the city’s challenges following the pandemic. India’s high-net-worth individuals—whose numbers are increasing—are also developing an appetite for expensive branded products and properties, while Puerto Rico is becoming a popular location for wealthy people seeking vacation properties or second homes.

In 2024, the global market for personal luxury goods experienced its first correction in 15 years. Although sales were down by little more than a percentage point from the previous year, some analysts believe the change could signal a potential slowdown in the luxury market overall. “All of the industry’s growth-driving engines have stalled,” was the assessment of consultancy McKinsey & Company in its January 2025 report The State of Luxury: How to Navigate a Slowdown.

However, analysts at fellow consultancy Bain & Company believe the long-term trend for luxury spending remains positive, though there has been a significant shift in consumer preferences, according to a press release from November 2024. “Luxury spending has shown remarkable stability this year despite macroeconomic uncertainty, largely driven by consumers’ appetite for luxury experiences,” said Claudia D’Arpizio, Bain & Company partner and lead author of the company’s annual Luxury Goods Report.

Bain’s tracking encompasses nine categories, including cars, hospitality, personal goods and art. There was a notable shift towards categories such as gourmet food and fine dining (up 8%) and private yachts and jets, with spending up by 13%. The market for cruises grew by 30%. Meanwhile, the 2025 Mid-Year Sotheby’s International Realty agent survey identified art and cars as the leading luxury products high-end homeowners also invest in.

Luxury consumer behavior doesn’t stop at goods and experiences—it has fundamentally reshaped expectations in high-end real estate markets as well.

The shift toward “experiential luxury” is an evolving consumer trait that has become prominent in real estate, particularly at premium price points. “What’s driving today’s high-end market is the feeling a home delivers as much as its address,” says Tammy Fahmi, senior vice president of global servicing and strategy, Sotheby’s International Realty. “What we’re witnessing in luxury real estate isn’t just a trend—it’s a fundamental redefinition of value. This experiential revolution transcends cultural boundaries, with buyers willing to pay substantial premiums for properties that offer exceptional features that reflect their lifestyles.”

This is backed up by findings in the 23rd edition of the annual Luxury Study, released in January 2025 by Bain & Company and Fondazione Altagamma, the trade association of Italian luxury goods manufacturers. According to the report, despite a slight decrease of 1% to 3% in overall luxury spending in 2024, which totaled €1.48 trillion globally, compared to the year before, “luxury experiences maintained faster-than-average growth as consumers continued to move their spending to travel and social events.” Looking ahead, the study’s research “suggests a slightly improving context throughout 2025… though this is highly dependent on the unfolding macroeconomic scenarios in key regions. Looking toward 2030, the market will likely embark on a long-term positive trajectory, with a growing addressable consumer base.”

Across each of the following markets, we observe distinct patterns in how luxury property and goods evolve together. In some regions, real estate investment precedes retail growth, while in others, established luxury experiences attract wealthy property buyers, demonstrating how these twin markets reflect and reinforce local wealth creation.

LUXURY SPENDING HAS SHOWN REMARKABLE STABILITY THIS YEAR DESPITE MACROECONOMIC UNCERTAINTY, LARGELY DRIVEN BY CONSUMERS’ APPETITE FOR LUXURY EXPERIENCES

Claudia D’Arpizio, Bain & Company partner

Not so long ago, reports from San Francisco, California, detailed the flight of retailers from the downtown area. Today, previously vacant stores are being occupied by brands that cater to the ultra-wealthy, transforming Union Square into a premier destination where shopping by appointment and prime European retailers are the norm, according to a February 2025 report from real estate data company CoStar.

It’s not just high-end retailers that have their sights on the city. An April 2025 report from Bloomberg, among others, shows growing interest and purchases of commercial properties from a range of big names, including Golden State Warriors’ star Stephen Curry, Google’s Sergey Brin and well-capitalized investment groups. On the residential side, agents are seeing growing demand for ultra-high-end properties.

“There is renewed confidence and momentum in San Francisco, particularly at the top end of the market,” says Neill Bassi, global real estate advisor, Sotheby’s International Realty - San Francisco Brokerage. “One of the things that defines San Francisco real estate is that it’s a momentum market, energized by the belief that tomorrow is going to be better than yesterday. There was a little bit of a lull for a short time, but if you ask anyone who’s buying today, their confidence is ultra-high.”

Bassi specializes in single-family homes within the city proper, where US$7 million to US$8 million is the threshold for luxury and the ultra-high market starts at or above US$20 million. “In 2024, we had more sales over US$20 million recorded in a single calendar year than ever before,” he says. A transaction led by Bassi, a US$30 million estate in Sea Cliff, has already set a record this year, as of April 2025. “If you look at the sales north of US$20 million last year, you’ll see some that are on double lots, fully renovated within the last 10 years or sooner, with big views. Then you’ll see others that are long-term, multi-year renovation projects in a once-in-a-generation location.”

Buyers today include former residents of the city who are returning after a hiatus of four or five years along with newcomers drawn by the city’s tech industry. Unlike the last surge of newcomers, who were drawn to Silicon Valley, those new to the city are apt to look north to Presidio Heights and Pacific Heights.

San Francisco is a place to create wealth and also to live a full, rich life, Bassi says. Education, proximity to top universities, access to cultural amenities like the opera and ballet, innovative tech ecosystems and healthcare are all essentials. “For the ultra-high-net-worth client, there is a real value proposition to commit to raising a family here,” he adds.

Source: Visit the Sotheby’s International Realty 2025 Luxury Outlook report for essential insights. |

|

| |

|

|

|

|

|

|