|

| |

|

|

| |

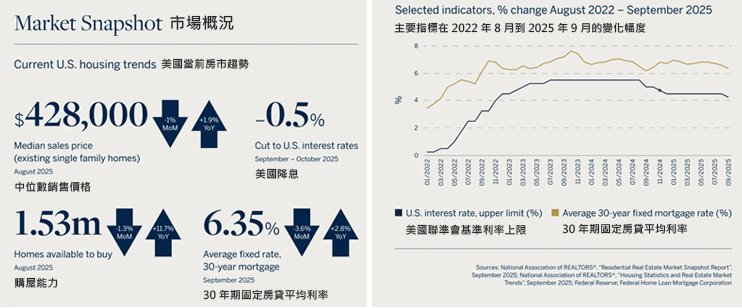

美國降息是否將帶動房地產市場?

連續兩次的美國降息主導了近幾個月的房地產走向。

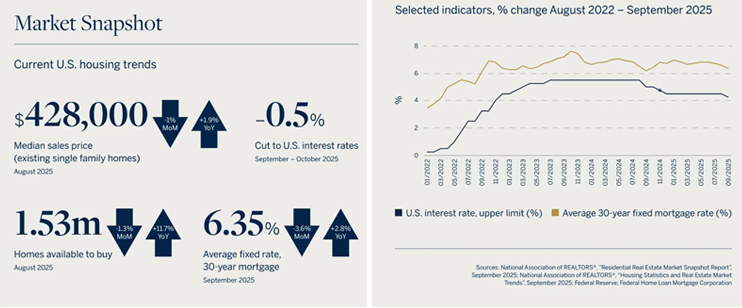

美國聯準會 ( Federal Reserve ) 於 9 月 17 日與 10 月 29 日分別降息 0.25%,將基準利率上限降至 4.00%,可能帶動房市活絡並刺激新屋開發。

隨著房市動能轉變,現在可能是購屋的好時機。

聯邦房屋貸款抵押公司 ( Federal Home Loan Mortgage Corporation ) 的數據顯示,30 年期固定房貸利率 9 月平均為 6.35%,低於 8 月的 6.59%。借貸成本下降,意味著購買力提升。

較低的房貸利率也將使許多豪宅買家受惠。根據 Realtor.com® 於 10 月 7 日發布的「 現金為王 」報告,在 2025 年上半年,約有 60% 的 100 萬美元以上交易使用房貸,但 200 萬美元以上的交易仍以現金支付為主。

全美不動產協會 NAR ( National Association of Realtors ) 於 2025 年 9 月發布的「 住宅房地產市場快照報告 」中的重要數據顯示,各價位的潛在買家都應積極入市。

NAR 表示,2025 年 8 月全美共有 153 萬套可供出售的房屋,較 7 月減少 1.3%,但較去年同期增加 11.7%。更多的房屋選擇意味著買家擁有更強的議價能力。

同時,房價漲幅維持平緩:NAR 於 9 月公布的「 成屋銷售 」數據顯示,2025 年 8 月全美單戶成屋的中位數售價為 427,800 美元 — 年增僅 1.9%,較 7 月下降 1%。

較低的利率與整體市場條件共同為「 精明買家提供了一個甜蜜點 ( sweet spot ) 」,NAR 副首席經濟學家暨研究副總裁 Jessica Lautz 博士表示。

她補充,如果利率持續下降,「 目標利率將在房貸市場引發多米諾效應。利率落在 6% 初段的情況,預計將持續至 2026 年。 」

文章節錄自 Sotheby’s International Realty 2025 奢華趨勢展望報告

|

|

| |

|

|

| |

|

|

| |

LUXURY LENS:WILL THE INTEREST RATE CUTS MOVE THE REAL ESTATE MARKET?

Two successive cuts to U.S. interest rates have dominated the real estate landscape these past months.

The Federal Reserve’s rate cuts of 0.25% on September 17 and October 29 – lowering its top interest rate to 4.00% – could boost the housing market and spur new home construction.

With real estate market momentum shifting, now could be the time to buy a property.

Federal Home Loan Mortgage Corporation data shows that 30-year fixed mortgage rates averaged 6.35% in September, down from 6.59% in August. Lower borrowing costs mean more purchasing power.

Lower mortgage rates will also benefit many luxury homebuyers. According to the Realtor.com® “Cash Is King” report, published October 7, roughly 60% of sales above US$1 million were mortgage-financed in the first half of 2025 – though a majority of sales over US$2 million were paid for in cash.

Key data from the “Residential Real Estate Market Snapshot Report,” published by the National Association of REALTORSⓇ (NAR) in September 2025, suggests potential homebuyers at all price points should get off the sidelines.

According to NAR, there were 1.53 million homes available to buy across the U.S. in August 2025, down 1.3% from July, but up 11.7% year-over-year. More homes to choose from means more negotiating power for homebuyers.

Meanwhile, home pricing has been subdued: NAR’s September-published “Existing-Homes Sales” data shows the median sales price for existing single-family homes was US$427,800 in August 2025—up just 1.9% year-over-year and 1% down from July.

Lower rates and wider market conditions together offer “savvy buyers a sweet spot,” says Dr. Jessica Lautz, deputy chief economist and vice president of research at NAR.

She adds that if rates continue to fall, “the target interest rate should have a domino effect into the mortgage market. Rates in the low 6% range should continue in 2026.”

Source: Visit the Sotheby’s International Realty 2025 Luxury Outlook report for essential insights. |

|

| |

|

|

|

|

|

|